This week continues my epiphany of this market. As we approach or even march into the dystopianism of urban life in many of our large metropolitan cities, I will harp on what I’ve been writing about for more than a dozen years.

I will start with #Community. I believe every single US Citizen desires Community. The wealthy man buys a Porsche and is instantly part of an elite community. A wealthy woman travels to Tuscany; same thing. Country clubs? Being part of something greater than themselves comes with the territory. The less affluent might become a part of a sewing club, a book club, volunteering at the food bank, being part of a faith or religion, or even part of a Homeowners Association. People naturally want to be a part of a community. This is why Homeownership is so, so, so, very important. It gives people Something to do, Something to love, and Something to hope for. It’s part of the American Fabric of Life.

The last part of my epiphany conversation continues to be about #WallStreet. If you follow me you know, Blackstone, Vanguard, StateStreet and more have a highly developed strategy of acquiring Single Family and Multifamily residences and becoming the world’s largest landlords. This strategy will effectively eliminate entry level residences from the first time buyer/homeowner. Historically, the entry level home has been the cornerstone of American Life. What will happen now?

Anyway, this week, Denver’s Single Family Residential Market looked like this over the last 7 days.

Market Watch

New Listings

1540 This number is huge! The largest number of 2023!

Coming Soon

174

Back On Market

294

Price Increase

190

Price Decrease

1560 This number just keeps growing. We’ve clearly moved past the price peak.

Pending

1105 A typical week, but not competitive with the above number of new listings.

Withdrawn

211

Leased

64

Closed

932 This is starting to be a seasonal trend not keeping up with supply!

Expired

234

As seen above, there are some bellwether number changes this week. Let’s see where we are going in this market. We could argue, this is great time to be a buyer; choice and low competition.

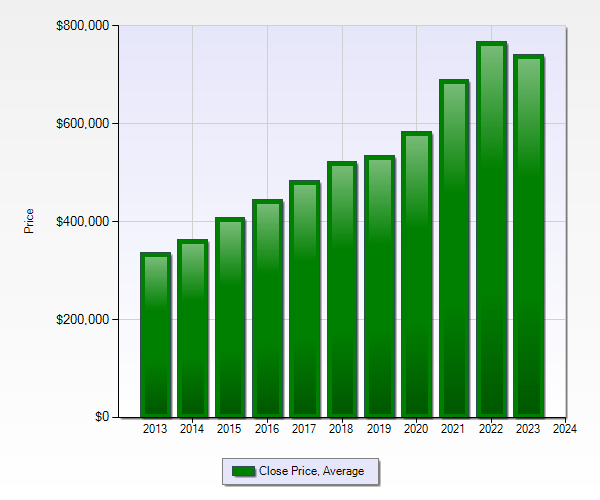

As I wrote above, we have reached our peak and started to witness average price decline. So, now let’s see how inventory is impacting this.

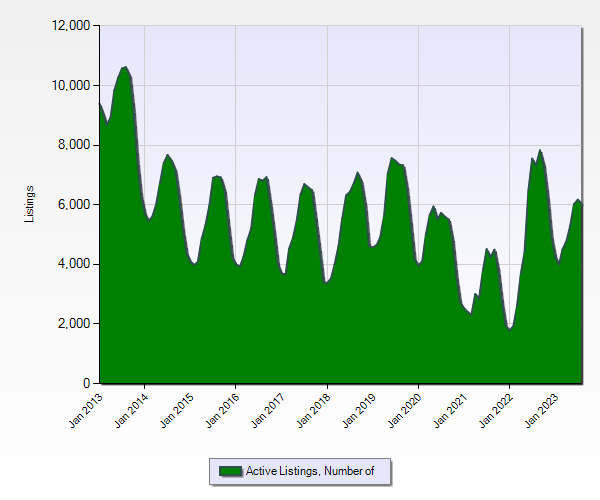

We have now seen the affects in Denver of High Interest Rates. There has been 7 consecutive months of slow and steady inventory growth. Still below years past, but nonetheless, inventory is growing, but the number of sales has remained stable or declined too.

This is the watershed newsletter. Is the beginning of wholesale price declines and the loss of value in this market? Keep in mind, we sill only have slightly more than 6,000 Active Listings in an 11 county metropolitan area of 3.25M. That is clearly NOT oversupply, but it is the first step?

With all of this, please be aware, this is not armageddon. If rates were to move toward 5%, this would change overnight. And, the current market continues to run, but just not as fast as 18 months ago. Let’s keep a close eye on this. I will continue to explore these trends everyweek, and keep you on track with the Denver SFR market. Please, stay tuned and tell your friends, family, aunts and uncles. We’ll be there for your homeownership journey!

You must be logged in to post a comment.