As we turn into the cul-de-sac of Q12025, it certainly has not been boring. I’m predicting more fireworks before the show is over. We had ten years of rough seas in the ’60s. I’d say we had another 10 years of rough seas in the ’70s. The ’80s were very rough economically. The ’90s fooled a lot of us, but eventually grew into the DotComm bust late in the decade. The early part of the 2000s were very wild with the “greatest recession since the great depression” toward the end as it was told. The 2K Teens offered all kinds of challenges. Now into the ’20s, we face a dramatic course of change. No body can predict the outcome.

There are opposing opinions on everything. Rates going up? Rates going down? Tariffs pushing inflation higher? Tariffs will force our trading partners to play fair?

Only in the days, weeks, months, and years ahead will we know. I can, however, tell you what happened last week, and where our inventory is trending with accuracy for next week. So let’s dive right in!

Denver Market Watch

New Listing

1514: A big jump in weekly listings this week; up almost 500 Active SFR Listings.

Coming Soon

291; This is a big jump here too, so more to come!

Back On Market

266

Price Increase

99

Price Decrease

1604; Still struggling with getting right the first time.

Pending

1223: A strong week, but not keeping up with New Listings.

Withdrawn

136

Leased

78

Closed

1173: This will be the first time this year when I have reported over 1,000 Closed Listings in one week.

Expired

535: This is a new high this year. Sellers looking to “go another direction”.

All in all, a good week for demand but an even better week for supply. Score this one for the buyers out there. Time to get off the couch!

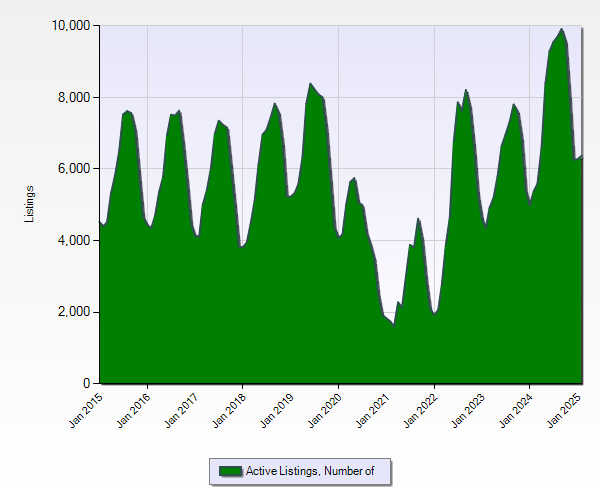

What has happened to the Total Supply of Active Single Family Listings?

The chart shows a flattening of total new active listings at 6,377 properties. This compares with 5,380 last year at this time. We have more supply, but it is nowhere near previous highs, but it will give buyers more choices. We are still waiting on lower interest rates, aren’t we? On all levels, we have buyers, sellers, and investors watching and waiting to see what will happen with rates. If you know, you might have a leg up on the rest of us. As the saying goes, “Marry your home and neighborhood, but date your rate, because you can always refinance later on.”

Here’s my prediction. Trump’s First Hundred Days will NOT be mellow, but rates will slowly work their way back to near 6% levels. Inventory in Denver will slowly increase as the supply outpaces demand in the short term. By fall, it will be the same story as 2024: not enough supply going into the winter months. We can handle this; no problem!

If you are on the fence, let’s talk about your plans for 2025 now, not later. Failure to plan is a plan for failure. We’ll be there for you every step of the way. We have buyers coming into the market, we have sellers going live on the market, and we can offer real-world, battle-tested strategies that have stood the test of time. An hour of your time with us can send you down the right path.

In the meantime, you can always catch up with us at TheCryerTeam@Kentwood.com.

You must be logged in to post a comment.