Good Morning Everyone,

This morning, I will show you how The Buyer in this market has taken the lead position. Additionally, I will show you how a seller can keep their equity in tact. The Denver Market has flipped from Seller to Buyer.

This week’s report of Denver’s Market over the last 7 days looks good to buyers, but it causes some fear in the hearts of sellers. The seller finally gets their house on the market, and then over the weekend, 1, 2, or 3 new listings come on the market down the street and around the corner. Buyers now have sellers competing for their attention, and that has become the Price Improvement Strategy. PIS Makes sellers angry. “I gave up everything to buy this house 5 years ago, but now, buyers are doing all kinds of inspections, examining everything”. Asking for Credits, Price Reductions and Repairs, the buyer is now in the catbird seat.

Let’s take a look:

| Denver Market Watch |

| New Listing (2041) If you are a buyer, you are happy to see this continual growth of new inventory each week. | |

| Coming Soon (178) This number is actually less than previous weeks. | |

| Back On Market (311) | |

| Price Increase (145) | |

| Price Decrease (2744) Holy Moly! WE just can’t get our list price right! | |

| Pending (1483) Not a bad week. This shows us buyers are out there, and ready. | |

| Withdrawn (231) | |

| Leased (0) | |

| Closed (1171) This is not a bad week, but it is not enough to maintain a Sellers’ Market. | |

| Expired (326) |

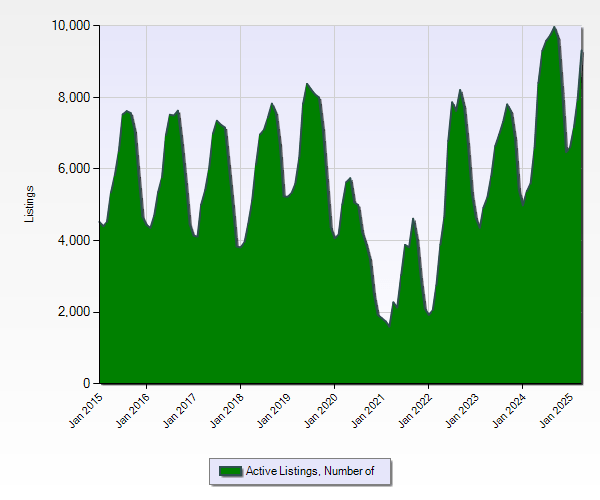

We hit 9,320 Active Listings this week. In the last 10 years, we have not seen a number this high. Last year at this time, we were at just under 6,600 Active Listings. As you observed above, as long as we have more New Listings, and fewer Closings, Inventory will continue to rise. More inventory only serves the buyer at this point! Keep in mind, based on weekly closings this is just shy of 8 weeks of inventory. 2 Months supply has never killed a market. We are still healthy, but we do have the flu.

The long trend of HIGH RATES is clearly taking its toll on this market. When someone at the lowest price range can’t get into the market, those subsequent transactions can’t take place. Long story short, until we see a break in interest rates (Affordability) we will continue to see inventory build. Remember, I am only showing you Single Family Residences. Attached and Condos are not in these numbers.

Summary of 30-Year Fixed Mortgage Rates (2015–2025)

Based on data from Freddie Mac, Mortgage News Daily, and other sources, here are the average annual 30-year fixed mortgage rates in the United States for each year from 2015 to 2025 (with 2025 data up to May):

2015: 4.09%

2016: 4.21%

2017: 4.04%

2018: 4.61%

2019: 3.76%

2020: 2.77%

2021: 3.27%

2022: 6.54%

2023: 6.67%

2024: 7.07%

2025: 6.88% (average through April 16, 2025)

In the spring and summer of 2022, when rates bounced off the lows of the year before, it has created chaos for the first time buyer. We went from a Seller telling us, “Why do I want to sell and appreciating asset, to a buyer telling us rates are too high” almost overnight, but it has taken 2 and half years to get here.

As we make our way toward the light at the end of tunnel please remember, we are out here everyday working for our clients. Please don’t hesitate to learn from our experiences and our experience. Every buyers’, and every sellers’ situation if different. Let’s make a plan together.

You must be logged in to post a comment.