It’s that time of year. Crosswalks with excited youngsters heading off to school. Buses will be crowded with the class clown making “points” with the driver, and a couple of kids will have their tops down on that birthday present that was ill-prescribed.

Things were hopping down at the elementary school as we dropped our granddaughter off. This seems so early. I can never remember a first day before Labor Day, And so early, before 8:00 AM, or you have to do the “walk of shame” through the front office. There was something special, however, watching our son drop his oldest off at the same elementary school.

I don’t think any of that has influenced last week’s MLS numbers:

| Denver Market Watch |

| New Listing (1344) Still stronger supply than demand, but there appears to be light at the end of the tunnel. | |

| Coming Soon (162) | |

| Back On Market (266) | |

| Price Increase (88) | |

| Price Decrease (2691) Inordinately high! | |

| Pending (1256) This is a pretty strong week. It is almost equal to New Listings. | |

| Withdrawn (241) | |

| Leased (0) | |

| Closed (983) With the closed properties lagging somewhat, between pending and closed, these are strong numbers. | |

| Expired (492) |

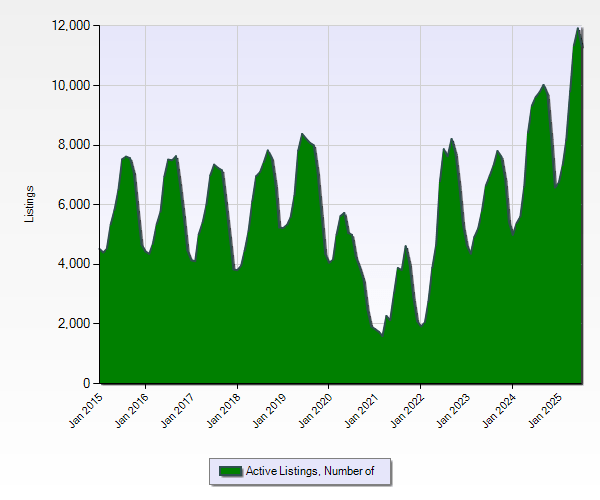

With the data above, how has this impacted the total supply of active listings on the Single Family Market:

With a total of 11,333 active listings currently, this is an improvement over last week, but it is not as significant as the week before. Long story short, we can proclaim stability(This Week), but how long will it last? To me, it feels like if we could just get a little relief in mortgage rates, we might see real stability. Once we can report a steady decline in competing inventory, we will maintain our hypothesis of a “buyer’s market”.

In the meantime, Dee and I still have relocation buyers moving to Denver. They still can’t find exactly what they want. Some are lifestyle moves, and some are corporate moves. On the seller side, we have several great opportunities coming up. “Will the circle be unbroken?” From the energy shortages of the ’70s, the high interest rates of the ’80s, the Dot Com Bust of the ’90s, the Financial Colapse of the 2000s, and now the inflation of the 2020s, we’ve been there. We’ve been apart of every “Boom and Bust” scenario. Please don’t underestimate the value of our life/market experiences, the 26+ transactions of our own, and the hundreds of transactions we’ve completed for people just like you.

We can always be reached at TheCryerTeam@Kentwood.com or 303-773-3399. Let’s make a plan. Thank You!

You must be logged in to post a comment.