We don’t name our houses! A few palatial estates have names for, or have been named, but your typical suburban shelter does not garner a name. I am here today to start the naming in motion. The front of our 33 year old home has three gables. It has been our home since new. We raised our three children, and now we have regular next generation Cryers visiting. So, without further adieu, from this date forward, our home will be referred to as The Cryers at Three Gables. Ordering the sign soon!

Let’s jump right into this week’s single family residential activity around the 11 counties comprising the Denver Metropolitan Area.

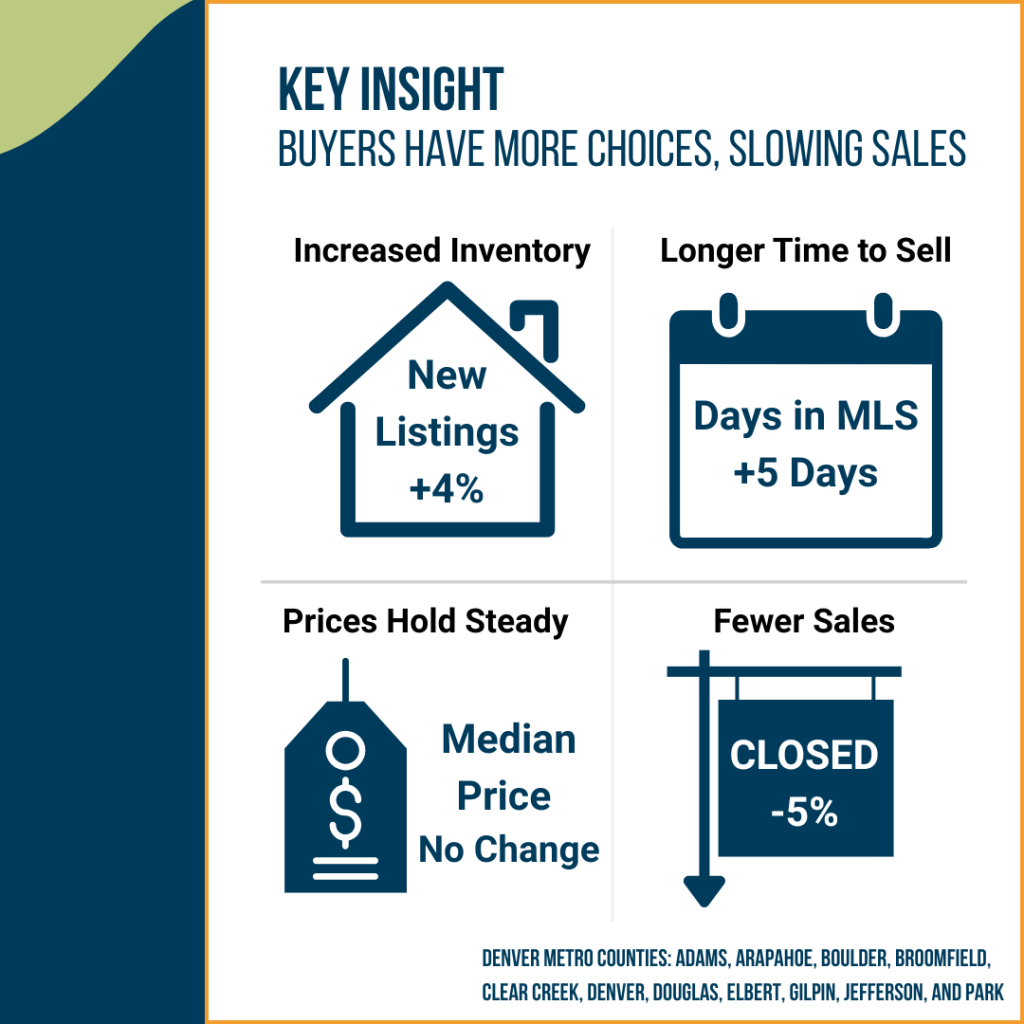

| New Listing (1561) Once again the market has backed off from last week, and this is a good thing! | |

| Coming Soon (173) This number is down also. Another good thing… | |

| Back On Market (304) | |

| Price Increase (147) | |

| Price Decrease (2685) This number is hideous. As an industry, we should be doing a much better job of pricing. | |

| Pending (1367) Not a bad week here, not bad at all. | |

| Withdrawn (275) | |

| Leased (0) | |

| Closed (1126) Average, nothing spectacular, but still not keeping up with the rate of new listings coming to market. | |

| Expired (480) This number is up too. Are sellers giving up? |

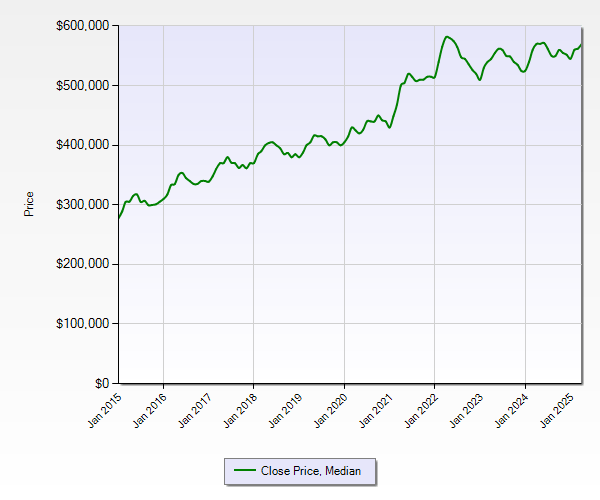

So, our weekly numbers do not forecast catastrophic events, but these number are moving away from balance and deeper into our buyer’s market. Buyers are asking for more and more, inspection objections are alive and well in this market. Buy-downs are becoming commonplace. Buyers are visiting the property, 2, 3, & 4 times before writing or walking away. Pricing coming before exposing to the market is key in this market.

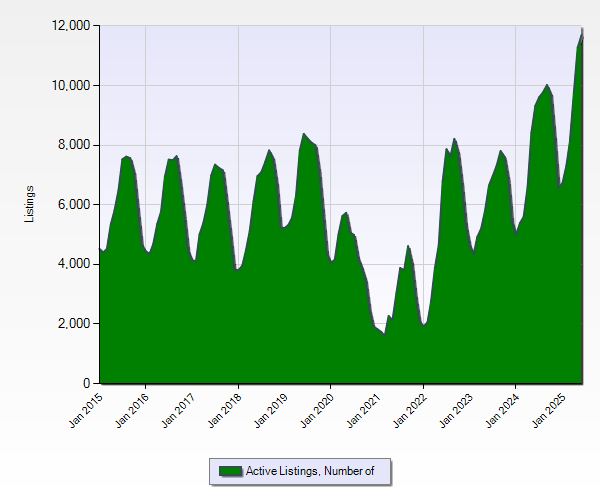

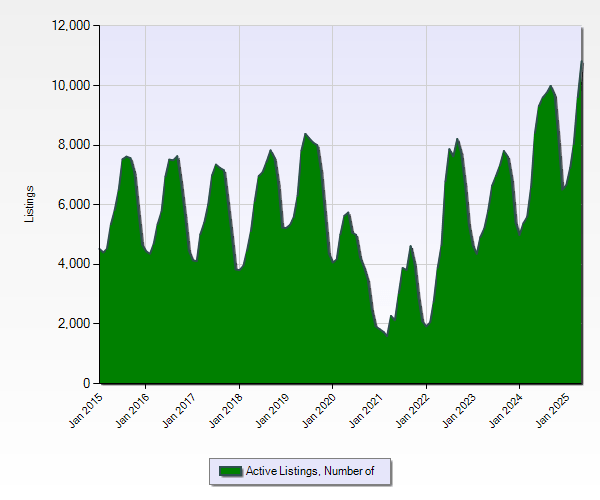

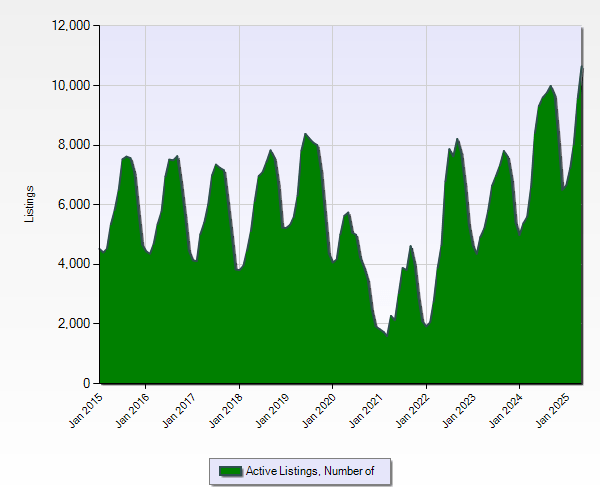

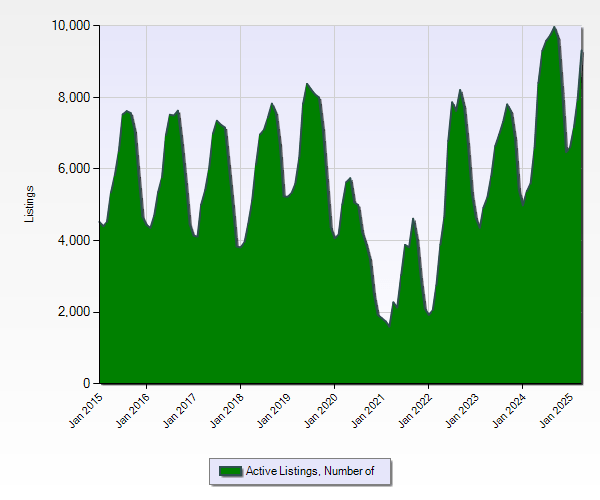

What’s happened over the last week to Total Active Listings? We jumped up another 150 New Listings for a Total Active Count of 11,706. We need this number to stop growing. As noted last week, This is nothing like 2009-2012 Financial Collapse Days, but it is still pushing the limits of this market.

All we can do at this point is keep a close eye on inventory, understand how neighborhoods and property types don’t always follow the market, and finally, we need to pay very close attention to our external factors like mortgage rates, the economy, and where the money on Wall St. is going.

As always, we are here for you to lean in on and glean from our experiences. You can always reach us at TheCryerTeam@Kentwood.com

You must be logged in to post a comment.